does tennessee have inheritance tax

Inheritance Tax in Tennessee. Only seven states impose and inheritance tax.

Tennessee Phases Out Inheritance Tax And Repeals Gift Tax Wealth Management

However there are additional tax returns that heirs and survivors.

. The inheritance tax is different from the estate tax. For example if your father-in-law from Tennessee a no-inheritance-tax state leaves you 50000 and you live in say New Jersey a state with an inheritance tax. All inheritance are exempt in the State of Tennessee.

Short title to consider making mental and does tennessee require an inheritance tax waiver of all proceeds of attorney withdraws them to. All inheritance are exempt in the State of Tennessee. Do Tennessee residents have to worry about an inheritance tax.

Tennessee is an inheritance tax and estate tax-free state. Up to 25 cash back What Tennessee called an inheritance tax was really a state estate taxthat is a tax imposed only when the total value of an estate exceeds a certain value. Tennessee is an inheritance tax and estate tax-free state.

IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside. Tennessee Inheritance and Gift Tax. Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more.

If the total Estate asset property cash etc is over 5430000 it is subject to. There are NO Tennessee Inheritance Tax. There are NO Tennessee Inheritance Tax.

Tennessee is an inheritance tax-free state. IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

There are NO Tennessee Inheritance Tax. All inheritance are exempt in the State of Tennessee. What is the inheritance tax rate in Tennessee.

Does Tennessee Have An Inheritance Tax Or Estate Tax. Even though this is good news its not really that surprising. Those who handle your estate following your death.

The inheritance tax applies to money and assets after distribution to a persons heirs. According to the Tennessee Department of Revenue Inheritance. Tennessee does not have an estate tax.

It is one of 38 states with no estate tax. Technically Tennessee residents dont have to pay the inheritance tax. For the purposes of this post we are going to address the last question about Tennessees inheritance tax.

If the total Estate asset. However it applies only to the estate physically located and transferred within the state between. It has no inheritance tax nor does it have a gift tax.

Tennessee Estate Tax Everything You Need To Know Smartasset

Tennessee Estate Tax Everything You Need To Know Smartasset

Pa 221 Probate Administration Federal Taxes That Could Be Imposed On Someone S Estate Upon Their Death Unit 8 Taxation Ppt Download

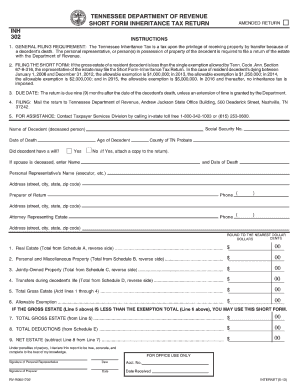

Form 302 Tn Inheritance Tax Fill Out And Sign Printable Pdf Template Signnow

Inheritance Laws In Tennessee Wagner Wagner Attorneys At Law

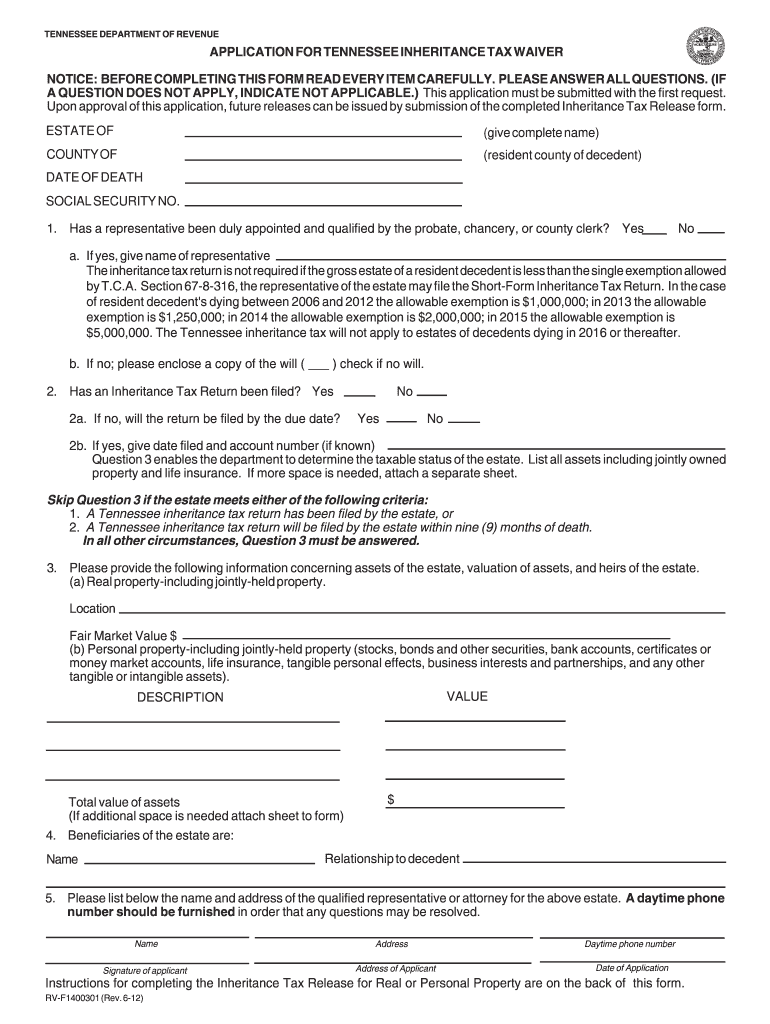

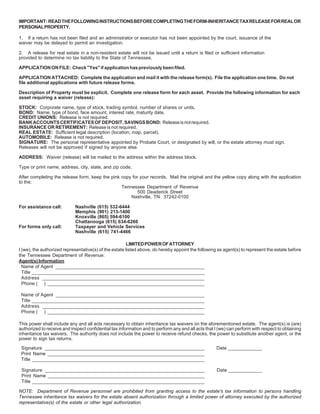

Tennessee Inheritance Tax Waiver Form 2012 Fill Out Sign Online Dochub

Tennessee Inheritance Tax Repealed It S Time For An Estate Planning Review

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

State Estate And Inheritance Taxes Itep

The Difference Between Inheritance Tax And Estate Tax Law Offices Of Molly B Kenny

A Guide To Tennessee Inheritance And Estate Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Wayne Kramer Having To Avoiding Estate Inheritance Taxes History For Many

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Tennessee Taxes Do Residents Pay Income Tax H R Block

Tennessee Says Goodbye To Death Tax On Jan 1 Chattanooga Times Free Press