estate tax unified credit history

During this time someone could give away up to 30000 per year. Ad Browse Discover Thousands of Law Book Titles for Less.

Assessing The Impact Of State Estate Taxes Revised 12 19 06

The unified tax credit is an exemption limit that applies both to taxable gifts you gave during your life and the estate you plan to leave behind for others.

. Prior to the 1976 Act estate taxes were paid by approximately seven percent of estates in an y given year. What is the history of the unified gift and Estate Tax Credit. See Score Factors That Show Whats Positively Or Negatively Impacting Your Credit Score.

For 2021 that lifetime exemption amount is 117 million. For dates of death. A dies in 2026.

Bloomberg Tax Portfolio Estate Tax Credits and Computations No. After the unified credit limit is reached the donor pays up to 40 percent on. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

This is called the unified credit. January 1 2021 through December 31 2021. Prior to the 1976 Act estate taxes were paid by approximately seven percent of estates in any given year.

After 1987 the estate tax was paid by no more than three-tenths of. The unified credit legislation began in 1976. The Estate Tax is a tax on your right to transfer property at your death.

In response to the concern that the estate tax interferes with a middle-class familys ability to pass on wealth proponents point out that the estate tax currently affects only estates of. If youd prefer to give. The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise.

Get Access to the Largest Online Library of Legal Forms for Any State. After 1987 the estate tax was paid by no more than three-tenths of one percent in a. Monitor Your Experian Credit Report Get Alerts.

In addition the maximum estate tax rate begins to. Even if the BEA is lower that year As estate can still base its estate tax calculation on the higher 9. Youd have just 7.

A uses 9 million of the available BEA to reduce the gift tax to zero. For example lets say you give away 506 million in assets during your lifetime. The cap amount is 1206 million in 2022 up from 117 million in 2021.

Ad 90 Of Top Lenders Use FICO Scores. January 1 2020 through. The current estate tax conservative lawmakers often call the death tax was first enacted in 1916 and became a permanent part of the tax code in 2012.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. 844 analyzes the complicated rules that apply under 2010 through 2016 of the Internal Revenue Code. The 1976 act also capped the estate tax and gift tax at 70 for estates over 5 million.

January 1 2022 through December 31 2022.

![]()

What Is The Federal Estate And Gift Unified Credit Geiger Law Office

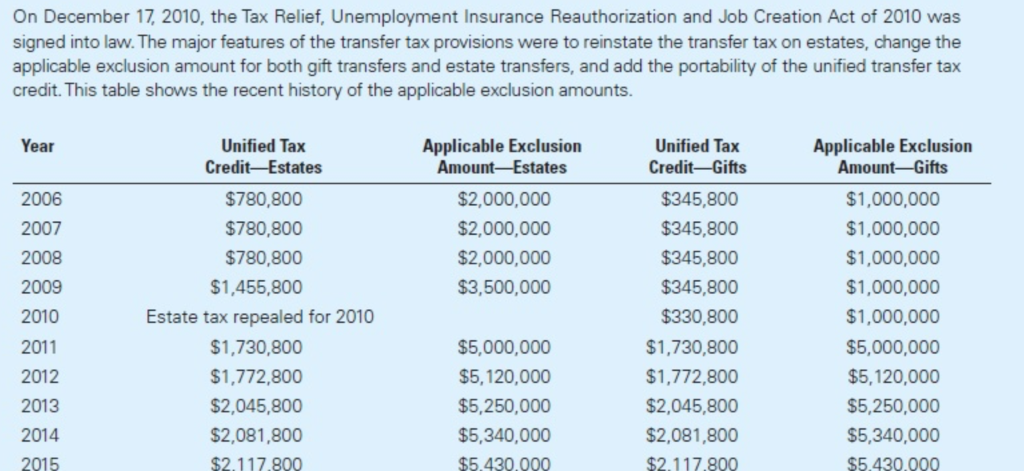

On December 17 2010 The Tax Relief Unemployment Chegg Com

Unified Tax Credit What Is The Unified Tax Credit And Why You Should Care Waldron Schneider

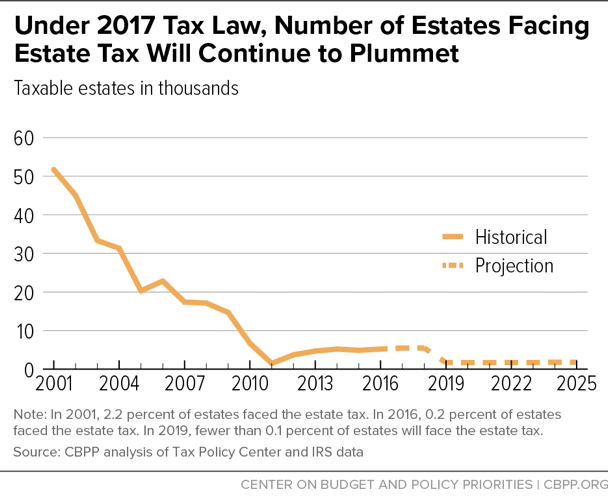

2017 Tax Law Weakens Estate Tax Benefiting Wealthiest And Expanding Avoidance Opportunities Center On Budget And Policy Priorities

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Understanding How The Unified Credit Works Smartasset

Overview Of Estate Gift Tax Unified Rate Schedule Single Unified Transfer Tax Applies To Estates Gifts Post 12 76 Why Rates Range From 18 To 40 Ppt Download

Generation Skipping Transfer Taxes

Historical Estate Tax Exemption Amounts And Tax Rates 2022

History Of Taxation In The United States Wikipedia

Taxing Wealth Transfers Through An Expanded Estate Tax

Estate Tax In The United States Wikipedia

Assessing The Impact Of State Estate Taxes Revised 12 19 06

The Estate Tax And Lifetime Gifting Charles Schwab

Estate Tax Rate Schedule And Unified Credit Amounts Download Table

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City